Accounting for sales return is mainly concerned with revising revenue and cost of goods sold previously recorded. Account receivable or cash and cash equivalents should also affect whether it is the cash sale or credit sales. In order to clearly understand the accounting for sales returns and allowances, let’s go through the example below.

Treatment of Sales Returns in the Financial Statements

Reverse the original journal entry by crediting your Accounts Receivable account. Although you don’t lose physical cash, you lose the amount you were going to receive. A purchase return, or sales return, is when a customer brings back a product they bought from a business, either for a refund or exchange. No matter how great your products are, you’re bound to have purchase returns at some point or another. It will help businesses if they have quality control in place, especially during production because this will ensure defect-free products.

Recording Sales Allowances

- If a customer made a cash purchase, decrease the Cash account with a credit.

- Revenues define the income from a company’s operations during an accounting period.

- On 1 January 2016, the Modern Trading Company sold merchandise for $2,500 to Small Retailers.

- Sales return and allowances are the contra account of the sales revenue account.

To indicate that dual posting is necessary, a diagonal line is drawn in the P.R. To illustrate, suppose that Lakeside Electronics issued the credit memorandum shown in the figure below to Champ’s TV Sales for the return of a defective 19-inch TV. The seller usually issues the customer a credit memorandum showing the amount of credit granted and the reason for the return. On 5th Feb 2020, the customer returned 5 pieces of product Y and 6 pieces of product Z to ABC cosmetics.

Are sales return a debit or credit?

It is a sales adjustments account that represents merchandise returns from customers, and deductions to the original selling price when the customer accepts defective products. Sales returns are a reduction in the actual sales which occurs when a customer, for whatever reason, returns the item for a cash refund or a credit to his/her account. The reason for a sales return is usually because of a product defect or a service failure. Sales returns can be thought of as reductions in sales, but they do not involve any cash outlay by the company. Accurate recording of sales returns and allowances is essential for any business owner looking to track their cash flow properly. Accounts, such as earned interest, sales discounts, and sales returns, are considered temporary accounts for accounting purposes.

Businesses will record an Accounts Receivable account and a Cost of Goods Sold account (if applicable) on the debit side. Understanding this entry is key for any business owner who wants to track their cash flow accurately. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

What is your current financial priority?

Now we have to deal with inventory/goods that customers just returned. Once the buyer identifies these problems, the buyer will normally need to return the goods cash disbursement journal definition and then ask for returning cash or reducing the credit balance. On 1 January 2016, the Modern Trading Company sold merchandise for $2,500 to Small Retailers.

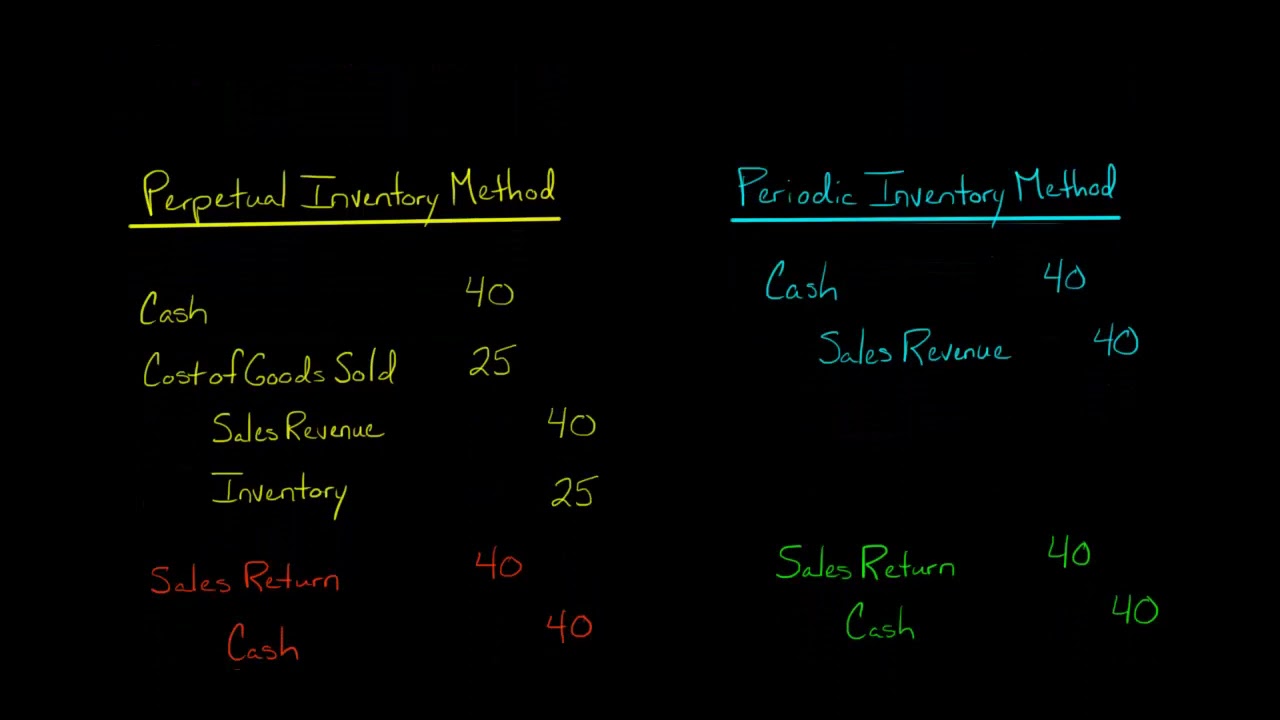

It is the contra entries of the sales account, increasing in debit and decreasing in credit. The main reason that is recording in debit while the sales return happened is that this account will decrease the total sale revenue. Under the periodic inventory system, there is only one journal entry to record the sales return and allowances. The cost of goods sold and a reduction in merchandise inventory is not recorded. Yes, if return goods are given back to the manufacturer by a customer, they have sales returns and allowances journal entries.

Here, you’ll get a picture of what those terms mean, what those figures are used for, and how to record them on your income statement. Some of the reasons why customers may return goods will include the following. This information should then be reconciled with the customer’s invoice to ensure accuracy in accounting records. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

This will also help clear the inventory faster than under normal circumstances. When the above entry was posted to the accounts receivable ledger, a small checkmark was made to the right of the diagonal line. As you can see, under the perpetual inventory system the cost of goods sold reduced by $400 while the merchandise inventory increased by the same amount as the return of the goods inward. This entry is made when a customer notifies the business that they will return the merchandise. In such circumstances, they usually prefer to retain the goods in question and ask for an allowance (e.g., price reduction) from the seller rather than returning the goods and asking for a refund. On 1 July 2014, it sold 500 footballs each to Club A and Club B at a price of $20 per football.

It usually appears as a line item in the income statement that shows the reduction in gross sales. The SRA normal balance is usually a debit balance, unlike sales accounts, which have a credit balance. Credit memos serve as vouchers for entries in the sales returns and allowances journal. Like debit memos, all credit memos are serially numbered, as shown below. Normally sales returns and allowances are two different kinds of transactions.

These should be set-up in the books before any transactions are made. Then, the allowance the customer receives is credited to the company’s accounts receivable. If your sales returns and allowances account is high compared to your revenue account, you may be offering too many discounts or have a product quality issue. You’ll record a total revenue credit of $50 to represent the full price of the shirt.